According to the Lumina Foundation-Gallup 2024 State of Higher Education study, published on Wednesday, 71% of current or former college students who dropped out before completing their program stated that they have postponed at least one significant life event due to their student loans.

Among individuals who had previously been enrolled in college, 35% mentioned that their loans prevented them from re-enrolling in a postsecondary program to finish their degree.

Illustrative Overview:

Homeownership Leads the List of Deferred Events

The study revealed that buying a home was the most frequently postponed event, cited by 29% of borrowers. This was followed closely by purchasing a car, moving out of their parents’ residence, and starting a business. Additionally, 15% of borrowers delayed having children, while 13% postponed marriage due to student loans.

Characteristics of Individuals Delaying Life Milestones

The study indicated that male borrowers (76%) were slightly more inclined than female borrowers (64%) to report delaying a major life event because of their loans.

Moreover, borrowers aged 26 to 35 (77%) exhibited higher delay rates, likely due to the relevance of these events in their current life stage and their typically higher student loan amounts compared to older peers.

The study also highlighted that the amount of student loan debt plays a crucial role in postponing major life events. Borrowers with substantial loan amounts were significantly more likely to delay purchasing a home, buying a car, or moving out compared to those with lesser debt burdens.

Over 90% of borrowers with over \(60,000 in student loans acknowledged delaying one or more major life events. Even borrowers with less than \)10,000 in loans reported a 63% rate of delaying significant milestones.

Methodology of the Study

The research was conducted between October 9 and November 16, 2023, through a web survey involving more than 14,000 current and prospective college students. This included over 6,000 students currently enrolled in post-high school education, over 5,000 adults with some college experience but no degree, and over 3,000 adults who had never been enrolled in postsecondary education.

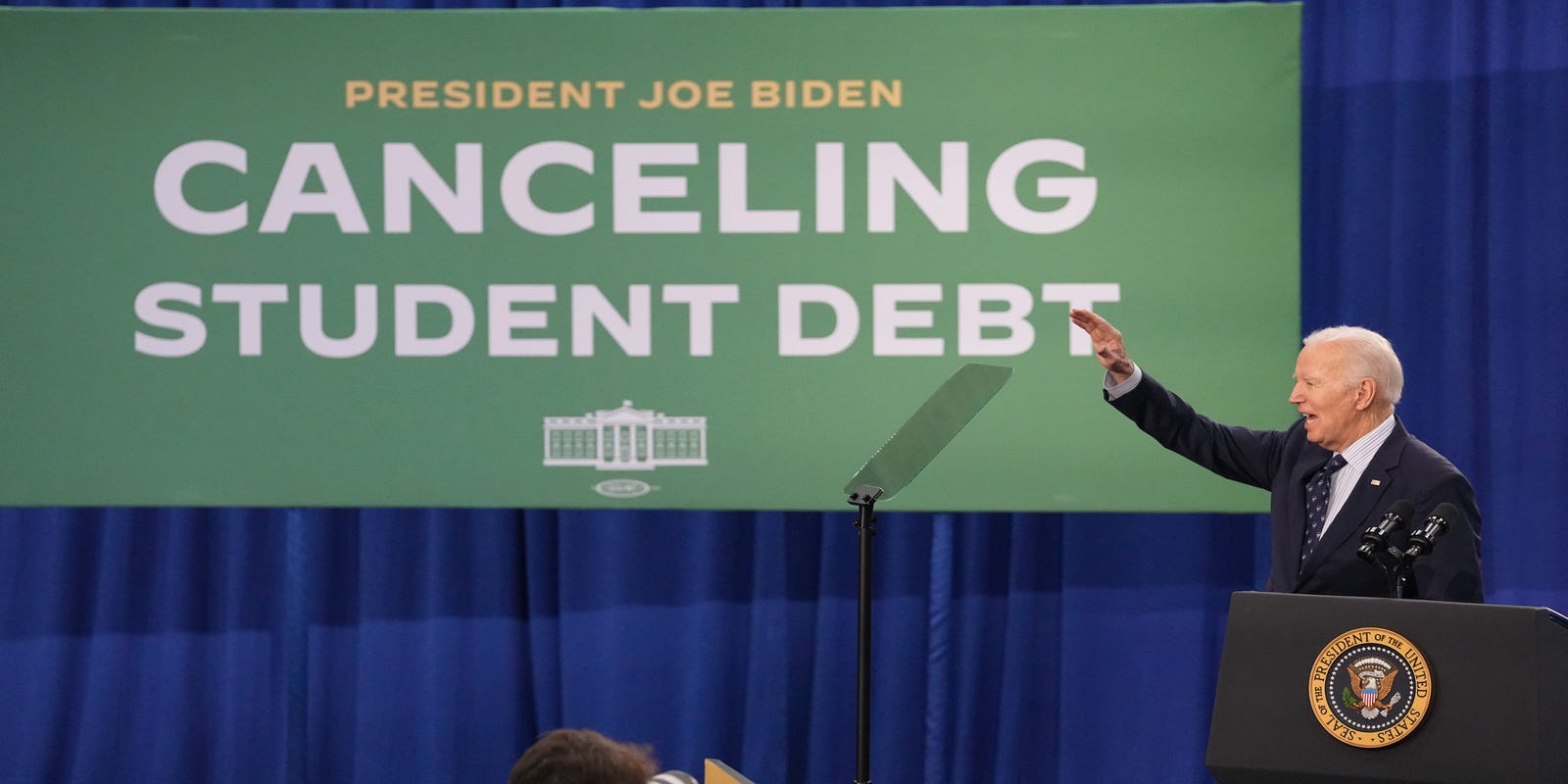

Student Loan Relief:

President Biden’s Announcement of $7.4 Billion in Student Loan Relief

President Joe Biden recently announced \(7.4 billion in student loan forgiveness for 277,000 borrowers. The canceled debt primarily benefits individuals enrolled in the Saving on a Valuable Education (SAVE) program, designed for borrowers who initially took out a small loan (\)12,000 or less) and have been repaying it for at least a decade.

Additionally, around 65,700 borrowers under other income-driven plans are receiving relief due to errors by loan servicers that placed them in forbearance. Administrative adjustments have rectified these issues, constituting nearly half of the forgiven loans announced last Friday.

Furthermore, a select group of borrowers, including those in government or community service positions, will have their loans relieved. This initiative is part of Biden’s efforts to address longstanding administrative challenges within the program.

The recent student loan forgiveness announcement brings the total amount forgiven under the Biden administration to $153 billion. Approximately 4.3 million Americans have benefited from student loan relief actions, equating to about 10% of federal borrowers approved for such assistance.

Contributors: Alia Wong & Zachary Schermele, USA TODAY

Gabe Hauari, a national trending news reporter at USA TODAY, can be followed on X or reached via email at [email protected].