Specialized life insurance plans exclusively available to the wealthiest Americans have come under scrutiny in a Senate report released on Wednesday, alleging that they serve as a means to evade billions in taxes. While the tax advantages associated with these high-end plans are within the bounds of the law, the Democratic-led committee has criticized them as a “booming tax dodge for the rich,” potentially shielding up to $40 billion. The committee has called for legislative action to restrict these plans and enhance tax disclosure requirements.

Revealing a previously obscure sector of the insurance market, the report highlights a potential focal point for Democrats in tax legislation. However, given the current polarization in Congress, passage of such measures remains uncertain. Opposition from the GOP-led House is expected, with several Republicans expressing concerns about the fairness of targeting wealthy taxpayers for tax compliance.

Distinct from conventional life insurance policies aimed at providing financial security in the event of a family provider’s death, Private Placement Life Insurance (PPLI) targets a select group of affluent individuals who view these policies as private investment vehicles. PPLI policies involve substantial initial premiums, sometimes reaching \(2 million, and necessitate policyholders to already possess at least \)5 million in other investments. The funds injected into these insurance accounts are then utilized by insurers to invest in exclusive options like hedge funds and private equity, inaccessible to the general public.

One key advantage of these policies is the tax exemption on income generated within the insurance policy, as well as on life insurance payouts. Moreover, policyholders can leverage the cash value of the policy through tax-free loans during their lifetime. Upon the policyholder’s demise, heirs can inherit the remaining funds without being subject to estate taxes.

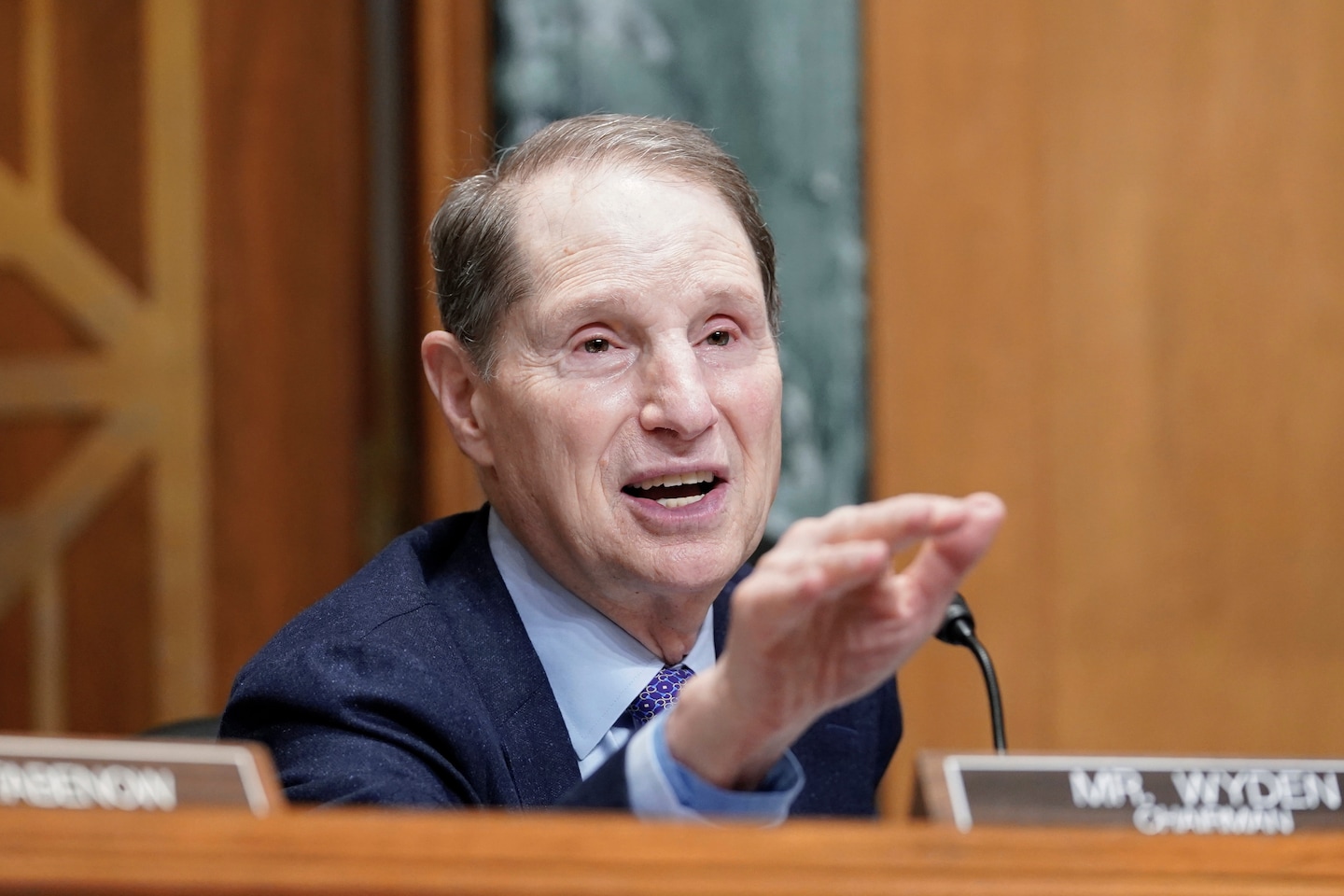

The committee, spearheaded by Sen. Ron Wyden (D-Ore.), has proposed various measures to address these tax advantages, ranging from stricter tax reporting requirements to potentially abolishing tax-free PPLI plans altogether. Wyden emphasized the legality of these practices, highlighting the need for regulatory changes to curb what he views as legal tax avoidance strategies for the ultra-wealthy.

The report scrutinizes the top providers of PPLI policies, revealing a concentration of wealth among a minute fraction of policyholders. Companies like John Hancock dominate the market, with substantial average death benefits conferred to policyholders. Despite assertions of compliance with existing regulations, questions have been raised about potential violations of the “investor control rule” by allowing policyholders excessive influence over investment decisions within their policies.

Looking ahead, Wyden has pledged to introduce legislation to address these concerns, including requirements for policyholders to disclose their PPLI holdings on tax returns. The debate surrounding the legality and ethical implications of these high-end insurance plans continues, with proposals for regulatory changes and limits on tax benefits to ultra-wealthy policyholders being considered.