A Devastating Scam Strikes a Duluth Couple

A phone call was all it took for a retired couple in Duluth to lose their life savings of $49,000. The scammers, posing as employees from Chase Bank, didn’t need to extract sensitive information like social security numbers or passwords from Gloria and Gary Moss. Instead, they utilized sophisticated tactics to impersonate the bank convincingly, causing the Mosses to believe they were speaking to genuine representatives.

Gloria Moss

Let’s go back to the phone call that started it.

The Mechanisms of the Scam

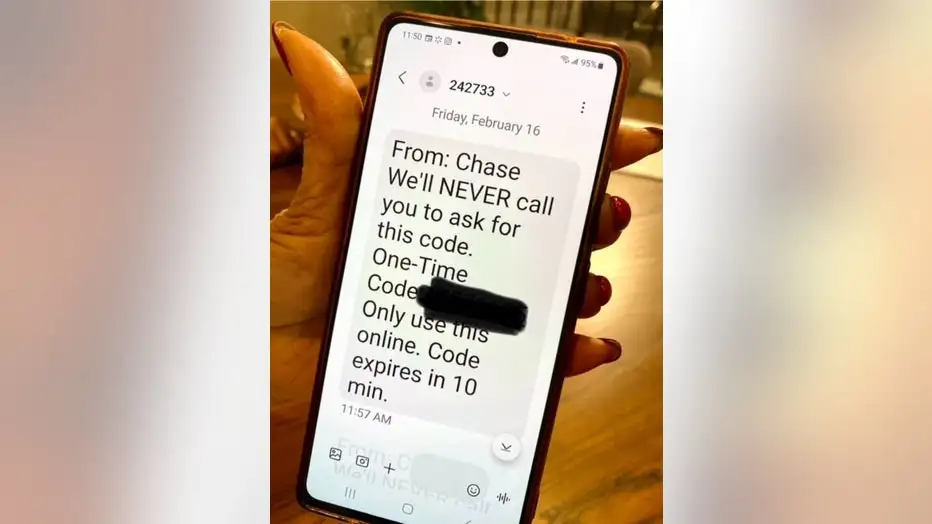

The deception began with fraudulent texts that mimicked Chase Bank’s fraud alert system, complete with the same short code used by the bank, which did not raise any suspicions for Gloria Moss. She responded by calling the number provided in the text, leading to a series of interactions with a seemingly professional representative. This person informed her of supposed unauthorized charges and proceeded to deactivate and supposedly reissue a new debit card for her husband, claiming to need a verification code sent to her phone to confirm her identity.

Aftermath and Ongoing Investigation

The realization of the scam dawned on the Mosses later that afternoon when unusual emails arrived, purportedly from Chase, notifying them of wire transfers they had never authorized. Despite efforts to reclaim their funds, only a fraction was returned by Wells Fargo, the bank to which the money was transferred. Chase Bank’s response was disheartening, stating they would not reimburse the stolen amount, citing that the transactions had been verified. Currently, the case has gained the attention of the Gwinnett Police Department, and the Mosses hold onto a sliver of hope that proving their phone was hacked might prompt a reevaluation of their case by Chase.

This incident highlights the evolving complexity of financial scams and underscores the critical importance of verifying communication directly through official channels, especially for vulnerable populations like retirees who may not be as familiar with such deceptive tactics.